car lease tax benefit

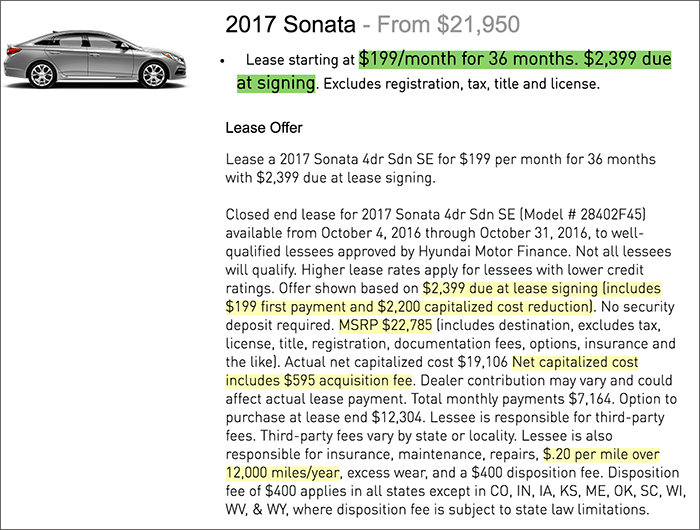

This tax is many times only included in the fine print of a car lease contract. Also the driver of a leased car must pay personal property tax on the car.

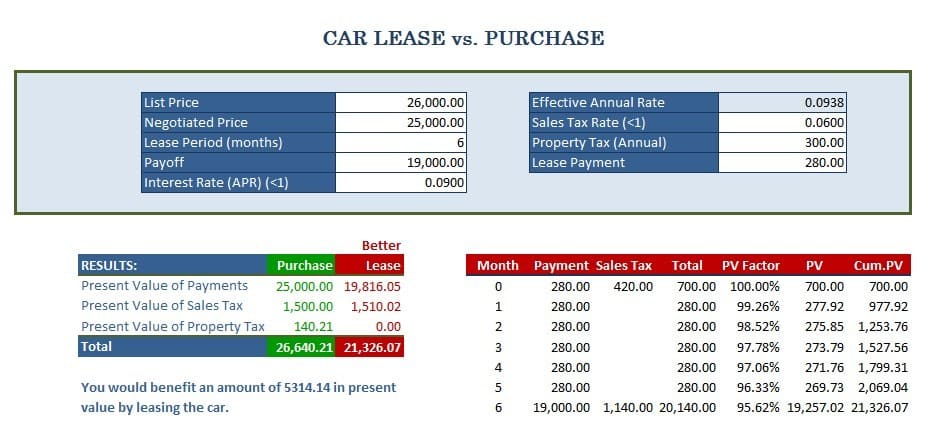

Quickly Figure Out If Your Lease Deal Is Good

The annual car insurance cost for a leased car is usually higher than for a purchased car.

. As with financing a car purchase a leasing company will use your credit score and history to determine whether or not it will lease to you. In some states no personal property tax is owed on a car that you are purchasing.

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

Is It Better To Buy Or Lease A Car Taxact Blog

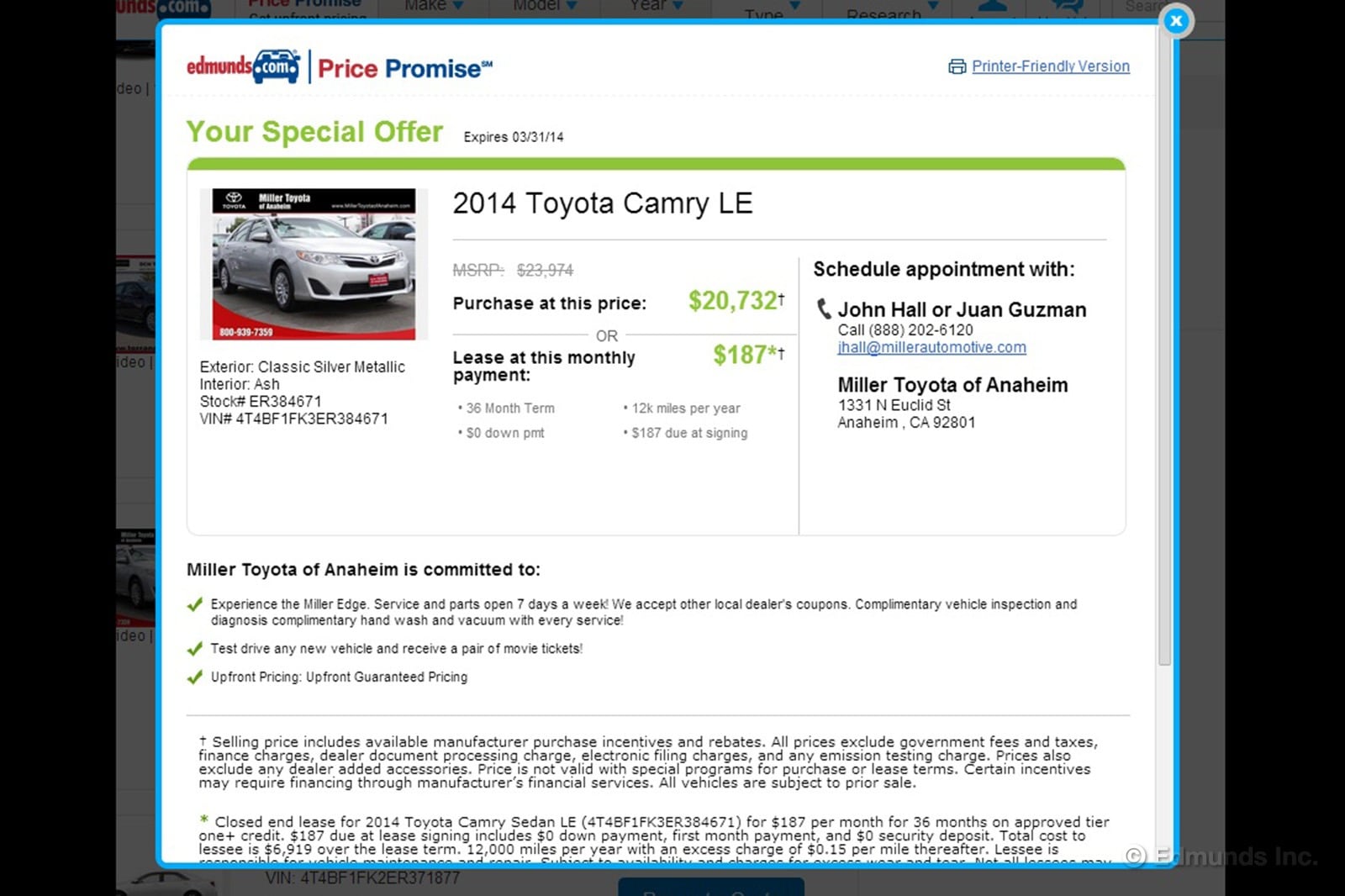

10 Steps To Leasing A New Car Edmunds

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Is It Better To Buy Or Lease A Car Taxact Blog

What S The Car Sales Tax In Each State Find The Best Car Price

Short Term Car Leases Vs Long Term Car Rentals Lendingtree

Is It Better To Buy Or Lease A Car Taxact Blog

What Are The Tax Benefits Of Leasing A Car For Business Debt Com

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is It Better To Buy Or Lease A Car Taxact Blog

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

New Business Vehicle Tax Deduction Buy Vs Lease Windes

Is It Better To Buy Or Lease A Car Taxact Blog

How Does Leasing A Car Work Earnest